UK tax increases are at the forefront of discussions following the revelation of a new budget presented by Chancellor of the Exchequer, Rachel Reeves, on November 26, 2025. This pivotal moment for the Labour party has sparked widespread debate concerning the implications of tax policy changes on UK public finances and economic stability. As the first woman to hold this high office, Reeves faces a dual challenge; she must navigate the discontent among Labour MPs while simultaneously reassuring market stakeholders. With the backdrop of Labour’s recent electoral success, questions arise about the viability of their leadership and their fiscal strategies, especially in light of rising public debt. As Reeves established a fine line between necessary economic adjustments and maintaining political favor, the impact of these tax hikes continues to resonate within political circles and the broader economy alike.

The recent spike in taxation has ignited conversations about the future of economic strategy in the United Kingdom, particularly with respect to the financial blueprint outlined by Chancellor Rachel Reeves. During her recent budget presentation, medium and long-term fiscal policies were highlighted, drawing attention to pressing issues within government financing. The Labour party’s commitment to revamping welfare benefits illustrates their approach to striking a balance between fiscal responsibility and social equity. Amidst pressures from both leftist factions and rising right-wing populism, the implications of these adjustments are pivotal for the party’s political standing. Markets are closely monitoring these developments, as the implications of current tax policy adjustments could redefine the landscape of UK public finances for years to come.

UK Tax Increases: A New Era in Fiscal Policy

In her recent budget presentation, Chancellor Rachel Reeves announced unprecedented tax increases aimed at addressing the UK’s fiscal challenges. The budget, revealed on November 26, 2025, marks a crucial turn in UK tax policy changes, reflecting the Labour party’s commitment to rebalancing public finances post-conservative austerity measures. These tax hikes are particularly significant, as they signal a departure from the previous government’s strategies, focusing instead on progressive taxation to support social welfare and public services.

Reeves’ approach to tax increases is intended not only to stabilize the UK public finances but also to foster economic resilience. By increasing taxes on higher earners and corporations, she hopes to raise the necessary revenue to fund her government’s initiatives, including the reinstatement of welfare benefits previously slashed. This strategy aims to alleviate the public’s concerns regarding austerity and shift the financial burden to those best able to absorb it. However, this move is not without its risks, as it may alienate certain voter segments who are sensitive to tax increases.

Rachel Reeves and the Labour Party’s Budget Dilemma

As Chancellor, Rachel Reeves faces growing pressure from within the Labour party regarding her handling of the UK budget for 2025. Following a historic victory in the general elections just eighteen months ago, the party’s recent dip in popularity has led to murmurs of discontent among members. Some Labour MPs are voicing their frustrations, suggesting that Reevel’s current policies, including significant tax increases, might be pushing voters away instead of drawing them in. This political tension adds another layer of complexity as she navigates her economic mandate.

The Labour party’s internal divisions are further exacerbated by external pressures from rival parties such as the Green Party and the far-right Reform UK, which are capitalising on Labour’s waning favourability in the polls. Amidst these challenges, Reeves must not only craft a budget that addresses pressing economic issues but also unify her party. Balancing the need for progressive tax policy changes with the party’s overall image is crucial for Labour’s long-term viability. Hence, her leadership is under scrutiny as members debate whether her strategy will ultimately redefine or hinder the party’s future.

The Economic Implications of Reeves’ Budget Proposal

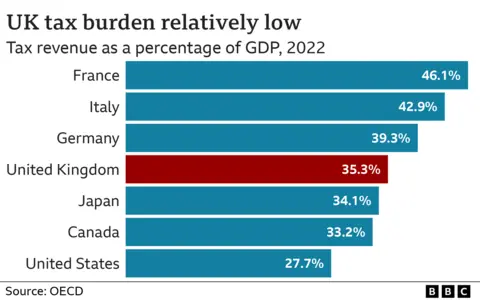

The economic implications of Chancellor Rachel Reeves’ budget proposal extend beyond immediate tax increases. By prioritising fiscal stability through these hikes, she aims to enhance the UK’s fiscal health amid a backdrop of concerning public finances. The Office for Budget Responsibility highlights that UK’s public debt remains perilously high at 95% of GDP, with an ongoing budget deficit of 5.1% of GDP. This context demands a robust response, and Reeves’ budget could potentially shift the economic landscape if executed effectively.

Furthermore, the desired outcomes of Reeves’ fiscal policies hinge on market reactions and public perception. Ensuring that the additional revenue from tax increases translates into improved public services and social welfare will be critical to retaining popular support. If the markets respond positively, it could enhance confidence in Labour’s ability to manage UK public finances, potentially reversing some of the party’s poll standings. However, if the reaction is negative, it could reinforce fears of a prolonged economic downturn, complicating her fiscal strategy even further.

Impact on UK Public Finances: A Balancing Act

Rachel Reeves’ recent tax increase announcements have far-reaching consequences for UK public finances. As she grapples with soaring public debt and persistent budget deficits, her challenge lies in implementing a sustainable fiscal framework that does not alienate voters. The Labour party aims to project an image of responsible governance, and these tax adjustments are framed as necessary steps to ensure long-term financial health. Nevertheless, the effectiveness of her plan will ultimately be assessed through its ability to produce tangible benefits for the public.

To manage these public finance challenges, it will be essential for the Labour party to articulate a clear vision that underscores the necessity of tax increases while ensuring that taxpayers see the direct benefits of their contributions through enhanced public services. Reeves must find a way to navigate the complexities of public sentiment while demonstrating accountability in the use of public funds. Ultimately, the success of her fiscal strategy will depend on her capability to foster trust and transparency in how the Labour party intends to reshape the UK’s economic future.

The Risks of Tax Policy Changes Under Labour’s Leadership

The recent tax policy changes introduced by Rachel Reeves possess inherent risks that could jeopardize the Labour party’s standing among voters. Foremost among these is the potential backlash from taxpayers who may feel burdened by increased taxes, particularly in an economic climate that is already strained. If these policy changes do not translate into immediate and visible improvements in public services or economic conditions, the Labour party could find itself facing substantial criticism.

Furthermore, these tax hikes may fuel oppositional narratives from rival political factions. Critics from the Conservative and Reform UK parties are likely to capitalise on any perceived failures of Reeves’ policies, portraying them as evidence of mismanagement or ineffectiveness. As the public’s patience wears thin, the Labour party must remain vigilant in addressing these challenges while ensuring that the narrative around tax increases aligns with their broader economic vision.

Reeves’ Strategic Vision for the UK Budget 2025

Chancellor Rachel Reeves’ strategic vision for the UK Budget 2025 encapsulates a commitment to sustainable economic growth and fiscal responsibility. Her focus on implementing tax increases reflects a clear intention to redirect revenue towards vital public services, marking a paradigm shift in the Labour party’s approach to fiscal policy. As the first woman to hold this high-ranking position, her leadership signifies an evolving economic narrative in the UK that prioritises social equity and investment in public welfare.

In curating this budget, Reeves aims to address long-standing social issues exacerbated by austerity, seemingly paving the way for a robust economic recovery. Her commitment to restoring welfare benefits, alongside the newly introduced tax structures, highlights a delicate balancing act between stimulating economic growth and managing public finances effectively. Success in this endeavour could position her as a formidable leader in tackling the complexities of UK’s economic future.

Challenges Facing the Labour Party Amid Economic Uncertainty

The Labour party is currently navigating a turbulent political landscape that raises significant challenges amidst economic uncertainty. Chancellor Rachel Reeves’ recent budget announcement, characterised by tax increases, is a bold move aimed at stabilising public finances against a backdrop of high debt and a growing deficit. However, the implications of these decisions extend beyond immediate fiscal concerns, as dissatisfaction among Labour MPs and the public complicate her mission.

As economic pressures mount, Reeves must ensure that the Labour party maintains a cohesive vision that resonates with voters’ needs. The rise of alternative political movements, such as the Green Party and the far-right Reform UK, further highlights the necessity for Labour to solidify its base and articulate clear solutions for pressing economic issues. Balancing these various pressures while pushing for necessary tax reforms will be crucial as the party strives to secure its position in UK politics.

Future Outlook for Labour’s Economic Policies Under Reeves

The future outlook for Labour’s economic policies under Chancellor Rachel Reeves hinges on her ability to execute a comprehensive and progressive economic strategy. The recent tax increases are just the initial steps in a long-term vision that aims to set the Labour government apart from its predecessors. By prioritising United Kingdom’s public welfare and economic equity, Reeves hopes to revitalise trust in Labour’s governance amid scepticism regarding its fiscal responsibility.

However, sustained public support will be essential for the success of these policies. Reevaluating public engagement strategies and actively communicating the rationale behind tax policy changes could serve to reinforce public sentiment in favour of Reeves’ government. If executed properly, her legacy could redefine Labour’s economic identity and pave the way for a more equitable and prosperous society. Nonetheless, she must remain adept at managing dissent within her party while heading off external criticisms as the Labour party seeks to establish a stable footing in UK governance.

Frequently Asked Questions

What were the key UK tax increases announced by Rachel Reeves during the UK budget 2025?

During the UK budget 2025 presentation, Chancellor Rachel Reeves announced significant tax increases aimed at addressing rising public debt and maintaining financial stability. These tax policy changes included higher rates of income tax for higher earners, an increase in corporate tax, and adjustments to tax reliefs, designed to bolster UK public finances amid growing economic pressures.

How do the recent tax policy changes affect UK public finances?

The recent tax policy changes introduced by Rachel Reeves are intended to strengthen UK public finances by increasing government revenue. With public debt at 95% of GDP, these UK tax increases aim to reduce the budget deficit, which stood at 5.1% of GDP as of March 2025, while also reinstating welfare benefits that had been reduced under previous Conservative administrations.

What are the implications of Labour party’s fiscal strategy in light of UK tax increases?

The Labour party’s fiscal strategy under Rachel Reeves, marked by significant UK tax increases, aims to strike a balance between enhancing public services and ensuring economic stability. The strategy reflects a commitment to not adopt austerity measures or reckless borrowing, while addressing criticisms from both the left and right of the party in the current political landscape.

Why did Rachel Reeves face challenges during the announcement of UK tax increases?

Rachel Reeves faced challenges during her announcement of UK tax increases due to growing dissatisfaction within the Labour party and pressure from both the Green Party and far-right reformists. With Labour’s recent electoral success now overshadowed by unpopularity in the polls, her task was to reassure wary Labour MPs and maintain investor confidence amidst troubling UK public finances.

What historical significance does Rachel Reeves hold as Chancellor regarding UK budget and tax increases?

Rachel Reeves made history as the first woman to serve as Chancellor of the Exchequer in the UK. Her recent handling of the UK budget 2025 and the subsequent significant tax increases reflects a transformative moment in UK politics, as she navigates the complexities of fiscal management and party dynamics during a challenging economic period.

How will the tax policy changes announced in the UK budget 2025 affect the average taxpayer?

The tax policy changes from the UK budget 2025, led by Rachel Reeves, will likely impact the average taxpayer through higher income tax brackets for earners above a certain threshold and an increase in VAT. These adjustments aim to generate necessary revenue for improved public services, although they may face backlash from constituents concerned about personal financial burdens.

What measures is the Labour party considering in response to the backlash against UK tax increases?

In response to the backlash against the significant UK tax increases, the Labour party is considering strategies to communicate the long-term benefits of these tax policy changes to both constituents and party members. This includes addressing concerns about public spending and welfare reinstatement, while trying to maintain unity within a party facing internal divides.

What was the economic context leading to the UK tax increases announced by Rachel Reeves?

The economic context surrounding the UK tax increases announced by Rachel Reeves includes a substantial public debt standing at 95% of GDP and a budget deficit of 5.1% of GDP as of March 2025. These economic pressures necessitated a strategic approach to tax increases to stabilize UK public finances without resorting to austerity measures, aiming for sustainable growth and investment.

| Key Point | Details |

|---|---|

| Chancellor’s Announcement | Rachel Reeves unveiled significant tax increases during her budget presentation on November 26, 2025. |

| Political Pressure | Faced criticism from Labour MPs and the challenge of keeping her position in the party amid growing dissatisfaction. |

| Historic Context | The presentation came after a historic general election victory, but her popularity has declined in recent polls. |

| Quotes | Reeves stated, “Those are my choices: not austerity, not reckless borrowing,” highlighting the reasoning behind tax hikes. |

| Welfare Benefits | Reeves proposed a reinstatement of welfare benefits that were cut by previous Conservative governments. |

| Public Debt Situation | As of 2025, UK public debt was 95% of GDP, with a budget deficit at 5.1% of GDP. |

| Market Reassurance | Reeves needed to reassure unsettled markets regarding public finances while balancing political survival. |

Summary

UK tax increases have become a critical topic of discussion following Chancellor Rachel Reeves’ announcement on November 26, 2025. In a politically charged environment, these tax hikes aim to address the challenges posed by public debt and budget deficits while attempting to restore welfare benefits. As the first female Chancellor, Reeves is navigating complex political dynamics within the Labour Party and public expectations, making her proposals a vital part of the UK’s fiscal strategy moving forward.