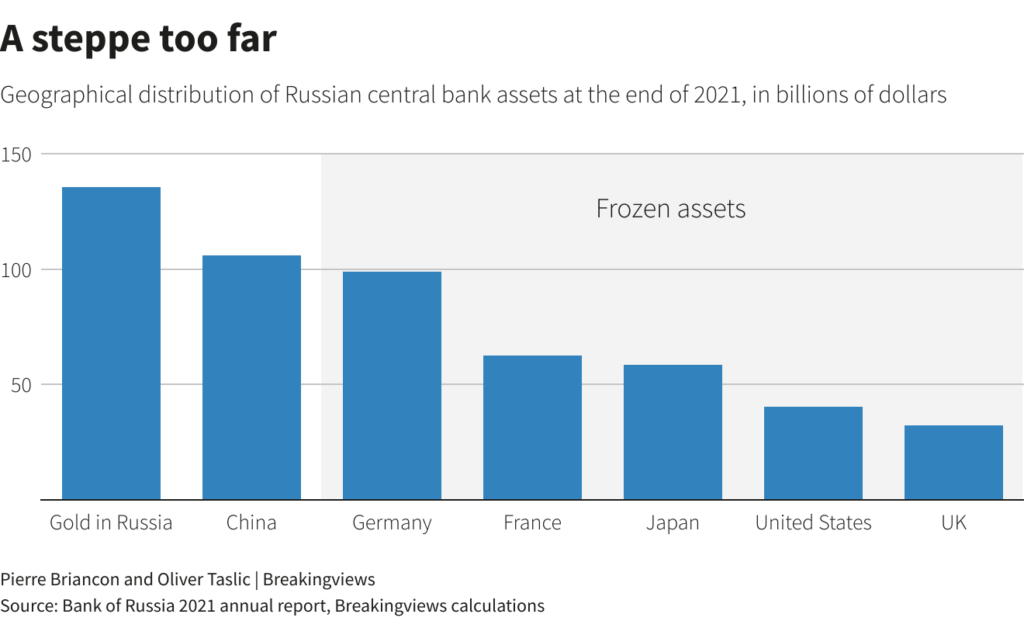

Frozen Russian assets are currently a focal point of discussion among European leaders as they convene at a crucial Brussels summit to address the future of €210 billion that remains inaccessible due to international sanctions following Russia’s invasion of Ukraine. This summit, scheduled for December 18 and 19, marks a pivotal moment for the European Union, which is grappling with the repercussions of Russian aggression and the necessity of Ukraine funding amid dwindling US support. The effective management of these frozen assets could enable Europe to not only bolster its credibility but also aid Ukraine through a potential reparations loan structured around these funds. The implications of choosing not to utilize these assets could be catastrophic, further undermining the EU’s ability to navigate international challenges. As discussions unfold, the overarching themes of cooperation and resilience will be key in addressing the pressing need for action against Russian threats.

As European leaders prepare to make decisions regarding the substantial financial resources currently immobilized due to sanctions against Russia, the landscape of international diplomacy hangs in the balance. The suspended funds, totalling €210 billion, serve as a stark reminder of the complexities involved in balancing strategic interests with legal constraints and humanitarian imperatives. With the backdrop of a fragile Ukrainian economy and escalating geopolitical tensions, leveraging these restricted resources could provide much-needed support through mechanisms like reparations loans. This pivotal moment at the Brussels summit highlights the European Union’s struggle to assert its influence amid challenges posed by Russian hostility and waning American backing. The outcomes of these negotiations will not only define the EU’s approach to foreign policy but will also signal its commitment to defending democratic values in the face of adversarial actions.

The Critical Role of Frozen Russian Assets in European Union Support for Ukraine

As European leaders prepare for the pivotal Brussels summit, the fate of €210 billion in frozen Russian assets is under intense scrutiny. These assets, effectively immobilized due to international sanctions following Russia’s invasion of Ukraine, present a unique opportunity for the European Union to bolster its support for Kyiv. The urgency of utilizing these resources cannot be overstated; as Ukraine faces potential financial collapse by 2026, the successful deployment of frozen assets could stimulate crucial funding and sustain the nation’s defenses against ongoing aggression.

Furthermore, leveraging frozen Russian assets aligns perfectly with the European Union’s broader economic strategy. By converting these assets into funds through mechanisms such as a reparations loan, the EU not only provides immediate financial relief to Ukraine but also reinforces its credibility on the global stage. This strategic maneuver positions the European Union as a decisive player in international relations, showcasing its commitment to countering not just Russian military aggression, but also the economic turmoil that accompanies it.

Implications of the Brussels Summit on EU’s Credibility and Unity

The upcoming Brussels summit is not just a meeting of heads of state; it represents a critical juncture for the European Union’s integrity. The decisions made regarding the frozen Russian assets will be scrutinized not only for their immediate effects on Ukraine but also for their longer-term implications on the EU’s cohesion in the face of external threats. With divisions among member states, particularly highlighted by Belgium’s hesitant stance, the summit will test whether the EU can present a united front in response to Russian aggression.

Moreover, the outcomes of this summit could either strengthen or weaken the EU’s standing within the international community. Failure to act decisively on frozen Russian assets could be perceived as capitulation, inviting further aggression from Russia and undermining the Union’s authority. In contrast, a unanimous decision to deploy these resources could energize the EU’s role as a leader in global security and diplomacy. This summit not only holds immediate stakes for Ukraine but will also resonate throughout Europe, setting a precedent for how the EU navigates future crises.

Challenges in Utilizing Frozen Assets and International Law

One of the foremost challenges in utilizing frozen Russian assets lies in adhering to international law. The proposal by the European Commission aims to transform these assets into loans for Ukraine while circumventing potential legal obstacles that come with outright confiscation. The delicate legal framework surrounding these funds calls for meticulous navigation to ensure compliance with international norms and regulations. By carefully structuring the financial arrangement, the EU hopes to provide vital support to Ukraine without triggering international backlashes.

The complexity of the situation is further compounded by the varying perspectives among member states regarding the legality and morality of using seized assets. While many agree that aiding Ukraine is a priority, concerns about setting a precedent for asset confiscation linger. This skepticism, particularly from nations like Belgium, emphasizes the need for a robust diplomatic dialogue to ensure all member states are on board with the proposed actions. A collaborative approach could help reaffirm the EU’s commitment not only to solidarity with Ukraine but also to upholding the rule of law.

Belgium’s Hesitation: A Political Dilemma for the EU

Belgium’s reluctance to fully support the deployment of frozen Russian assets raises profound political questions within the European Union. Belgian Prime Minister Bart De Wever’s concerns about potential reprisals against Euroclear staff highlight the intricate interdependencies that exist within European financial systems. His caution reflects broader fears of destabilization that may arise from aggressive actions by Russian officials, suggesting a need for stronger protective measures for EU entities facing such threats.

However, De Wever’s stance begs further examination, particularly in the context of his remarks on the desirability of Russia not losing the war. This raises essential questions about Belgium’s commitment to the collective EU stance against Russian aggression. The divide between national interests and European solidarity is becoming increasingly pronounced, testing the unity of the 27 member states. Although the EU has the capability to move forward without Belgium’s support, the political ramifications could be severe, potentially exacerbating existing tensions and revealing fractures within the bloc.

The Need for a Unified EU Strategy Against Russian Aggression

As the threat of Russian aggression looms large, developing a unified strategy becomes imperative for the European Union. The utilization of frozen Russian assets should not merely be seen as a financial mechanism but as part of a broader strategy to safeguard European security. A cohesive approach among all member states is crucial to send a clear message to Moscow that the EU stands resolute against threats to its sovereignty and stability.

Moreover, a unified stance on using the frozen assets can help mitigate divisions between member states and reinforce a collective identity within the EU. This strategy could serve not only to support Ukraine effectively but also to establish the EU as a formidable entity in international affairs. By presenting a common front, the EU would not only support Ukraine’s immediate needs but also assert its legitimacy as a defender of European values and sovereignty, which is increasingly tested in contemporary geopolitics.

Potential Consequences of Inaction on Frozen Assets

The consequences of inaction concerning frozen Russian assets could be dire for the European Union’s long-term credibility and operational integrity. Failing to utilize these funds risks sending a signal of weakness, suggesting that the EU cannot effectively respond to external threats. This caution could embolden aggressor states, undermining the achievable stability and security within Europe, whilst eroding public confidence in the Union’s capability to enact meaningful change.

Additionally, not employing these frozen assets could have severe financial repercussions for Ukraine. As the country grapples with potentially disastrous financial forecasts, the EU’s inability to act might precipitate a crisis that extends beyond its borders, causing wider instability throughout the region. Consequently, it becomes vital for EU leaders to recognize that employing these assets is not merely an economic decision but is intrinsically linked to the broader narrative of European unity and security in the face of adversity.

The Role of Reparations Loans in Supporting Ukraine’s Recovery

Reparations loans represent a significant innovation in financing for Ukraine’s recovery efforts. By utilizing frozen Russian assets to fund these loans, the European Union can help ensure that Ukraine has access to the necessary resources to rebuild and stabilize its economy in the aftermath of the ongoing conflict. This financial strategy serves a dual purpose: it not only supports Ukraine in its urgent need for assistance but also creates a mechanism for accountability for the damages inflicted by Russian aggression.

Furthermore, reparations loans might also set a compelling precedent for future international conflicts. By structuring aid to come from funds associated with aggressor states, the EU could engage in a more proactive approach to international law and support. Such a framework underlines the necessity for aggressor states to bear responsibility for their actions while providing immediate relief to affected nations. Thus, reparations loans could be an essential tool for fostering long-term recovery prospects in Ukraine and reinforcing a rules-based international order.

Strengthening EU’s Global Influence through Strategic Asset Deployment

The strategic deployment of frozen Russian assets presents an unparalleled opportunity for the European Union to enhance its influence on the global stage. By taking decisive action at the Brussels summit, the EU can demonstrate leadership and commitment to its principles, asserting its role in shaping international responses to aggression and warfare. The effective use of these assets could establish the EU as a pivotal player in international diplomacy, promoting a vision of collective and proactive engagement.

In doing so, the European Union not only addresses immediate needs but also shapes its future relationships with non-EU partners. By showcasing its preparedness to tackle significant geopolitical challenges, the EU can foster greater collaboration with allies who share similar values in defending democracy and the rule of law. The summit’s outcomes could thus not only impact the situation in Ukraine but also redefine the parameters of EU relations worldwide.

Conclusion: A Call for Decisive Action at the Brussels Summit

As the Brussels summit approaches, there is a palpable need for decisive action regarding the frozen Russian assets. The implications of the discussions extend far beyond financial considerations; they reflect the European Union’s commitment to collective security, international law, and robust solidarity with Ukraine. Leaders must recognize that inaction could carry far-reaching negative consequences, undermining the credibility of the EU as a whole.

Therefore, encouraging a thorough evaluation of the proposals surrounding the use of frozen assets is critical. By standing united, the member states can send a powerful message, not just to Russia but to the global community, affirming their dedication to supporting Ukraine and maintaining peace and stability in Europe. The decisions made at the Brussels summit could serve as a pivotal moment in defining the EU’s collective response to aggression and reaffirming its commitment to essential democratic principles.

Frequently Asked Questions

What is the significance of frozen Russian assets for the European Union?

The frozen Russian assets, amounting to €210 billion, represent a crucial resource for the European Union amid ongoing Russian aggression. Utilizing these assets could strengthen the EU’s credibility and provide essential funding for Ukraine, enhancing the bloc’s efforts to address the financial crisis stemming from the invasion.

How will the EU address the legal challenges related to frozen Russian assets?

The European Commission has proposed a mechanism to utilize the frozen Russian assets while complying with international law. By allowing institutions holding these assets to lend them at favorable rates, the EU can generate funds to support Ukraine without characterizing it as confiscation.

What role will frozen Russian assets play in funding Ukraine’s defense?

Frozen Russian assets are planned to be utilized through a reparations loan system aimed at financing Ukraine’s defense efforts. This strategy seeks to generate necessary funds while anticipating that Russia will eventually compensate for wartime damages.

What are the risks associated with the decision on frozen Russian assets at the Brussels summit?

The Brussels summit’s decision on frozen Russian assets carries significant risks. Ignoring the assets could undermine the EU’s ability to confront challenges posed by Russian aggression, while forcing a resolution may spark a crisis within the 27 member states. Balancing these concerns is crucial for European unity.

Why are frozen Russian assets a contentious issue among EU member states?

The frozen Russian assets are contentious due to differing national interests. For instance, Belgium’s concerns about threats to institutions like Euroclear reflect the complications of handling these assets in light of legal challenges and political implications, highlighting the need for a cohesive EU approach.

How could the Brussels summit impact the future of Ukrainian funding through frozen Russian assets?

The outcomes of the Brussels summit will significantly influence future funding channels for Ukraine. If the EU agrees on utilizing frozen Russian assets, it could establish a precedent for leveraging these resources to support Ukraine and demonstrate the bloc’s commitment to confronting Russian aggression.

What has been the response of EU leaders towards the utilization of frozen Russian assets?

Most EU leaders support the proposal to use frozen Russian assets to aid Ukraine, as it demonstrates a unified approach against Russian aggression. However, the reservation from member states like Belgium poses challenges to finalizing this strategy, potentially affecting its implementation.

| Key Points | Details |

|---|---|

| Crucial Decision | European leaders will discuss frozen Russian assets worth €210 billion at a summit in Brussels. |

| Timing | The summit takes place on December 18-19, a critical moment for EU unity and action. |

| Legal Challenges | Utilization of these assets requires navigating complex international laws and sanctions. |

| EU’s Credibility | Using frozen Russian assets is presented as essential for maintaining confidence in the EU amid ongoing Russian aggression. |

| Proposal Support | A majority of EU member states back the proposal to use the assets as a ‘reparations loan’ for Ukraine, except for Belgium due to concerns over threats from Russia. |

| Urgent Need | Ukraine faces financial depletion by mid-2026, making the release of these assets critical for ongoing support. |

| Political Implications | Belgian Prime Minister’s opposition raises questions about regional support for Ukraine and wider EU unity. |

| Consequences of Inaction | Failure to act on the frozen assets could be seen as weakness, impacting the EU’s ability to confront future challenges. |

| Repercussions | Forcing a resolution may lead to a political crisis, but not utilizing the assets might send a harmful message regarding EU resolve. |

Summary

Frozen Russian assets remain a pivotal topic for the European Union and its future direction. The upcoming Brussels summit represents a critical juncture where EU leaders must determine how to effectively utilize €210 billion in assets to support Ukraine while navigating complex legal and political landscapes. The decision made could significantly influence not only the EU’s credibility and response to Russian aggression but also its unity in confronting future challenges.