US economic growth has surged impressively in the third quarter, recording an annualized rate of 4.3%, the highest in two years according to recent GDP data. This unexpected surge can be attributed largely to increased consumer spending, which outpaced economic forecasts and provided a much-needed boost to the nation’s economy. However, the same report indicated rising inflation rates, prompting discussions around the future implications for US monetary policy. Analysts believe that while consumer spending and exports are increasing, significant investments into sectors like artificial intelligence hold potential for sustained growth. As the world watches the evolution of these economic indicators, it becomes clear that US economic growth remains a pivotal topic in the global marketplace, reflecting both opportunities and challenges on the horizon.

The recent acceleration of fiscal expansion in the United States marks a notable period of economic advancement, evident through an impressive GDP growth figure. With an increase in consumer expenditure and a dynamic investment landscape, particularly in technology sectors such as AI, the nation’s financial fabric appears robust. While inflation rates pose a challenge, they also fuel discussions concerning adjustments in monetary strategies to navigate the shifting economic landscape. As the country balances these forces, the vitality of consumer confidence and federal policies plays a crucial role in shaping future development. Ultimately, the trajectory of this economic revolution signifies not only growth but also the complexities of managing an evolving market.

US Economic Growth: A Record Surge in Q3

The latest GDP report has unveiled a remarkable surge in US economic growth, reaching an impressive annualized rate of 4.3% in the third quarter of the year. This growth easily outperformed expert expectations, showcasing the resilience of the US economy amidst various challenges, including a precarious labor market and fluctuations in consumer confidence. The driving force behind this notable increase appears to stem from robust consumer spending, reflecting a renewed willingness among households to invest in goods and services. As consumer confidence rebounds, it contributes significantly to GDP growth, underscoring the interconnectedness of these economic indicators.

However, while the overall economic outlook shines, the report does signal potential pitfalls. The acceleration of inflation rates to 3.4% has raised eyebrows as it indicates higher price pressures compared to the previous quarter’s 2.0%. Such inflationary movements could shift the Federal Reserve’s monetary policy approach, prompting new discussions on interest rates and economic stability. Indeed, the interplay between GDP growth, consumer spending, and inflation will be crucial to monitor in the upcoming months as policymakers navigate these complex economic waters.

Consumer Spending: The Backbone of Economic Growth

Consumer spending emerged as a vital pillar supporting the recent acceleration in US economic growth. Enhanced consumer confidence encourages households to increase their spending, which, in turn, propels the economy forward. As businesses ramp up production and services to meet this demand, GDP growth is invariably influenced by the fluctuations in consumer behavior. Recent reports indicate a discernible rise in expenditures, with many citizens investing in durable goods and services, marking a shift from prior periods of cautious spending.

This trend of heightened consumer spending not only enhances economic growth but also fosters a positive feedback loop within the economy. Increased demand often leads to job creation, which further stimulates consumer confidence and spending, contributing to a thriving economic environment. However, analysts caution that while the data reflects optimism, it is essential for consumers to maintain a balance amidst rising inflation rates, ensuring that their spending remains sustainable and beneficial in the long run.

The Impact of Inflation Rates on Economic Stability

The recent rise in inflation rates, climbing to 3.4%, poses challenges to the US economy, creating a complex landscape for monetary policy and economic growth. Higher inflation can erode purchasing power, impacting consumer spending and savings, which are crucial for sustained economic growth. Furthermore, as inflation rates move beyond the Federal Reserve’s 2% target, there may be increased pressure on the central bank to adjust interest rates in a bid to control price growth and stabilize the economy.

Economists attentively note the delicate balance required to manage inflation without sacrificing growth. Rising prices may compel the Federal Reserve to reconsider its current monetary policy strategy, leading to potential rate hikes that could dampen economic momentum. It will be critical for the central bank to navigate these changes effectively, ensuring that measures taken to curb inflation do not inadvertently stifle consumer spending and investment, which are integral to the economic growth trajectory.

Monetary Policy: Adapting to Rising Economic Pressures

As inflation accelerates, the Federal Reserve faces the looming challenge of adapting its monetary policy to the evolving economic landscape. The current economic growth, propelled by strong consumer spending, must be balanced against the inflationary pressures that accompany such growth. The Fed’s recent decisions to lower interest rates reflect its commitment to stimulating economic activity while responding to labor market shifts. However, the rising inflation rates create a scenario where the Fed’s dual mandate of fostering maximum employment and stable prices becomes increasingly complex.

Future monetary policy decisions will likely hinge on a careful analysis of inflationary trends and consumer behavior. The Federal Reserve’s ability to respond proactively to these economic signals will be pivotal in sustaining growth while managing inflation. Policymakers must remain vigilant, ready to implement adjustments in interest rates to temper inflation without hindering the ongoing economic recovery marked by remarkable GDP growth.

AI Investment: Fueling Future Economic Prospects

The increasing trend of artificial intelligence (AI) investment is emerging as a cornerstone of future economic growth, reflecting a broader technological evolution within the US economy. Major tech companies, including OpenAI and Google, are leading this investment boom, which has significant implications for productivity and innovation across various sectors. As these companies dedicate resources to develop robust AI solutions, they drive advancements that not only create jobs but also enhance operational efficiencies, thereby contributing to overall economic growth and stability.

However, the implications of such AI investments extend beyond immediate economic outcomes. While fostering market innovation, this investment paradigm also poses questions about regulatory frameworks and future labor market dynamics. Policymakers must navigate these challenges, ensuring that the evolution of AI contributes positively to economic conditions while also addressing potential concerns related to employment displacement and the necessity for workforce retraining. The intersection of AI advances and economic growth presents both opportunities and hurdles for the future.

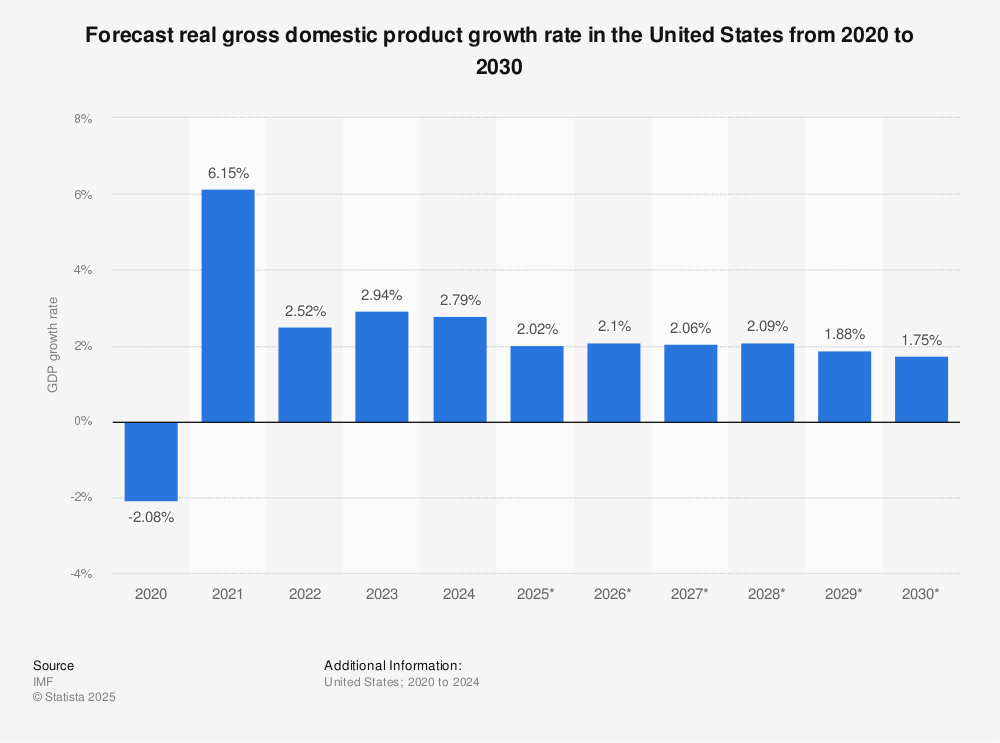

Analyzing GDP Growth Trends: What Lies Ahead?

The notable GDP growth of 4.3% reflected in the recent report underscores a pivotal moment for the US economy, highlighting both its current strengths and future challenges. Analysts project that while this growth is promising, it must be viewed within the context of evolving economic indicators, including inflation rates and consumer sentiment. As the Federal Reserve updates its economic forecasts, it emphasizes a balanced approach to growth, acknowledging the necessity to maintain healthy GDP figures alongside stable inflation targets.

In analyzing GDP growth trends, economists stress the importance of adaptability. The rapidly changing economic environment—marked by consumer spending fluctuations, inflationary pressures, and investments in innovation—demands a responsive fiscal and monetary policy framework. Forecasting GDP growth requires not only an understanding of current trends but also an analytical approach to potential disruptions that could impact the trajectory of the economy moving forward.

Trade Policies and Their Role in Economic Growth

The relationship between trade policies and economic growth has come into sharper focus as recent agreements have reduced uncertainties surrounding tariffs and other trade barriers. The easing of trade tensions, particularly between the US and major economies like China, has been received as a positive signal for businesses and investors. These developments not only bolster consumer confidence but also promote a more fluid economic environment, essential for sustaining GDP growth.

However, while easing trade policies offer short-term benefits, long-term economic stability will be determined by how effectively the US navigates its international trade relationships. Policymakers will need to balance aggressive trade negotiations with broader geopolitical considerations to prevent potential instability that could counteract the gains achieved through improved trade relations. Effectively managing these dynamics will be crucial as the US aims to maximize its economic growth potential.

Job Market Trends and Their Impact on Economic Growth

The interplay between job market trends and economic growth remains a critical area of focus as the US economy experiences fluctuations in labor demand. Recent reports indicate a weakening labor market, which poses risks for continued GDP growth. As consumer spending often hinges on job security and income levels, a decline in employment could result in reduced consumer confidence and spending, ultimately dampening economic momentum.

To mitigate these challenges, it is essential for policymakers and business leaders to implement strategies that reinforce job creation and support workforce development. By investing in training programs and addressing skills gaps, the US can improve job market resilience, fostering a more stable environment for economic growth. The relationship between job market health and overall economic performance cannot be understated, making it imperative to sustain both employment and consumer confidence.

The Future of US Economic Growth: Challenges and Opportunities

As we look towards the future of US economic growth, a multitude of challenges and opportunities surfaces. The interplay between rising inflation rates, evolving consumer behavior, and the impact of AI investments will shape the economic landscape in the coming years. Policymakers must remain proactive, carefully monitoring these variables to harness growth potential while addressing underlying risks. Sustained GDP growth ultimately hinges on a dynamic economy that can adapt and respond to changing market conditions.

Furthermore, building a resilient economy will necessitate collaboration between government, businesses, and educational institutions. This partnership is essential for fostering innovation, adapting to technological advancements, and preparing the workforce for future demands. By prioritizing investments in education and infrastructure, the US can position itself for enduring economic growth, ensuring that it remains competitive on the global stage. The path forward is multifaceted, requiring a collective effort to navigate the complexities of the modern economy.

Frequently Asked Questions

What factors contributed to the recent US economic growth in GDP?

The recent surge in US economic growth, with a GDP growth rate of 4.3% in the third quarter, was largely driven by increased consumer spending, higher exports, and government expenditures. However, this growth was partially offset by a decrease in overall investment.

How does consumer spending affect US economic growth?

Consumer spending plays a crucial role in US economic growth, accounting for a significant portion of the GDP. The recent increase in consumer spending has been a key factor in driving the robust GDP growth observed in the latest quarter.

What are the implications of rising inflation rates on US economic growth?

Rising inflation rates, which have accelerated to 3.4% in the latest report, could complicate the economic landscape. While higher inflation can indicate strong demand, it may also prompt adjustments in monetary policy that can impact overall US economic growth.

How does US monetary policy influence economic growth?

US monetary policy is designed to manage economic growth through interest rates and money supply regulation. The Federal Reserve’s decisions on interest rates, influenced by inflation and employment data, play a vital role in shaping the trajectory of US economic growth.

What is the potential impact of AI investment on US economic growth?

AI investment is poised to significantly boost US economic growth by driving innovation and productivity. Major tech companies are making substantial investments in developing artificial intelligence infrastructure, which can enhance various sectors of the economy.

Why are analysts optimistic about the future of US economic growth?

Analysts express optimism about the future of US economic growth due to factors like improved consumer spending, diminishing trade policy uncertainty, and robust AI investment. The Federal Reserve’s updated GDP forecasts also suggest a brighter economic outlook.

How do tariff policies affect US economic growth?

Tariff policies can influence US economic growth by impacting trade relations and investment sentiment. The easing of tariff concerns under the current administration has contributed to a more positive economic outlook, supporting growth in consumer spending and overall GDP.

What challenges does the US economy face despite positive growth indicators?

Despite positive indicators like GDP growth and increased consumer spending, the US economy faces challenges such as rising inflation rates and a potentially weakening labor market, which may complicate future growth and monetary policy decisions.

| Key Point | Details |

|---|---|

| US Economic Growth Rate | 4.3% annualized growth in Q3 2025, highest in two years. |

| Consumer Spending | Increased consumer spending driven GDP growth. |

| Inflation Rate | Price index for domestic purchases rose 3.4%, up from 2.0%. |

| Economic Outlook | Initial GDP estimate may be updated in early 2026, with a forecasted 2.3% for 2026. |

| Federal Reserve Policy | Fed prioritizing job market concerns despite high inflation; rates likely to remain steady. |

| Tariff Concerns | Diminished tariff worries after agreements reached with China and others. |

| AI Investment | Significant investments from tech giants like OpenAI and Google boosting economic outlook. |

Summary

US economic growth showed significant improvement in the third quarter of 2025, registering a remarkable annualized growth rate of 4.3%. This growth, primarily fueled by increased consumer spending and supported by favorable macroeconomic conditions, signals a positive turnaround for the economy. Despite a rise in inflation and ongoing concerns in the labor market, the reduced uncertainties regarding tariffs and strong investments in artificial intelligence infrastructure suggest a potentially stable economic environment moving forward. Overall, while challenges remain, US economic growth appears to be on a firm upward trajectory.