Venezuelan oil sales have emerged as a pivotal topic in the ongoing debate over U.S. energy policy and international relations. With the backdrop of a tumultuous political landscape in Venezuela, U.S. Energy Secretary Chris Wright announced that the United States will maintain control over these critical oil exports indefinitely. This decision comes as the U.S. seeks to stabilize the Venezuelan oil industry while potentially lifting sanctions to rejuvenate its production capabilities. As both nations navigate this complex relationship, understanding the implications of U.S. control over Venezuelan oil becomes increasingly essential, especially considering Venezuela’s vast reserves, which comprise about one-fifth of the world’s total oil supply. Through strategic oversight, the U.S. aims to not only manage these oil sales but also to revitalize a once-thriving sector crucial to the country’s economy.

The management of oil exports from Venezuela has become a focal point of geopolitical strategy amidst significant shifts in leadership and policy. Following the U.S. government’s intervention in Venezuelan affairs, the oversight of refining and selling oil has been entrusted to American officials, highlighting a complex interplay between national interests and global energy dynamics. Chris Wright, the U.S. Energy Secretary, envisions a future where the Venezuelan oil industry can be restored to its former glory through planned investments and infrastructural support. As the U.S. positions itself as a key player in stabilizing Venezuela’s oil sector, the implications for international markets and energy dependencies are becoming increasingly noteworthy. By analyzing the evolving landscape of Venezuela’s oil economy, we gain insight into broader trends in energy management and cross-border economic relationships.

The Future of Venezuelan Oil Sales Under US Control

The landscape of Venezuelan oil sales has undergone a seismic shift following the United States’ declaration of indefinite control over these transactions. Energy Secretary Chris Wright’s assertions indicate that the US will take charge of marketing the nation’s crude oil, specifically utilizing the stored reserves to kickstart shipments. This novel approach not only aims to stabilize Venezuela’s beleaguered oil industry but also signals a broader shift in US energy policy, particularly as it relates to managing foreign oil exports. As the US positions itself as a central player in this dynamic, the implications for global oil markets and Venezuela’s economic recovery are profound.

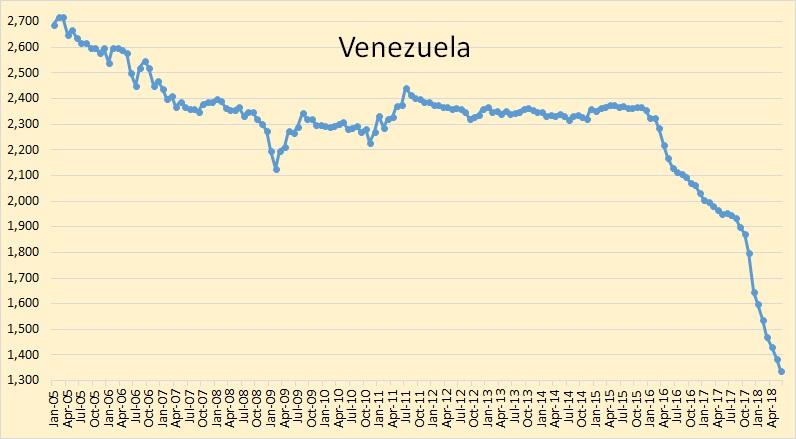

Effective control over Venezuelan oil exports means that the US can influence not just the prices of crude oil but also the geopolitical landscape in which these sales occur. This oversight may lead to the gradual lifting of sanctions on Venezuela’s oil sector, contingent upon cooperation from its interim government. By navigating the complexities of the Venezuelan oil market, the US aims to revitalize an industry that previously produced over three million barrels per day, although experts warn that significant investments are required. Thus, the future of Venezuelan oil sales under US control rests on a precarious balance of cooperation, financial investment, and geopolitical maneuvering.

Frequently Asked Questions

How will US control of Venezuelan oil sales impact Venezuela’s oil exports?

The US control of Venezuelan oil sales is expected to significantly affect Venezuela’s oil exports by overseeing the marketing and sales process. This includes managing 30 to 50 million barrels of crude oil, which may help stabilize the oil sector and potentially increase export volumes as sanctions are reevaluated.

What is the significance of Chris Wright’s statement on US energy policy regarding Venezuelan oil?

Chris Wright’s statement on US energy policy highlights a strategic shift in managing Venezuelan oil sales. By stating that the US will control these oil sales indefinitely, it signals a deeper involvement in Venezuela’s oil industry and aims to revitalize production while ensuring supply chains are maintained.

What challenges does the Venezuelan oil industry face under US management?

The Venezuelan oil industry faces numerous challenges, including aging infrastructure, political instability, and the need for significant capital investment to restore production levels. US management may help address some of these issues, but revitalization could take considerable time and resources.

How might US sanctions affect Venezuelan oil exports in the future?

US sanctions have been a major hindrance to Venezuelan oil exports. However, as US control potentially facilitates a more ordered approach to sales, sanctions might be lifted selectively, allowing for an increase in exports and revenue generation to revitalize the sector.

What role will the US play in the Venezuelan oil supply chain?

The US will act as a key supplier in the Venezuelan oil supply chain by providing necessary diluents for Venezuela’s extra-heavy crude oil. This support aims to enhance the exportability of Venezuelan oil and is part of the broader strategy to stabilize and grow the Venezuelan oil industry.

What are the potential financial implications of Venezuelan oil sales under US control?

Under US control, Venezuelan oil sales could yield substantial financial implications, potentially generating over $2 billion from the sale of 30 to 50 million barrels. These revenues, however, depend on market conditions and could be subject to legal and political complexities surrounding the interim Venezuelan leadership.

What does the US Energy Secretary mean by needing ‘tens of billions of dollars’ for Venezuelan oil revitalization?

US Energy Secretary Chris Wright indicates that revitalizing the Venezuelan oil industry will require significant capital investment—estimated in the tens of billions of dollars—to overcome infrastructure issues, acquire necessary parts, and stabilize production levels.

| Key Point | Details |

|---|---|

| US Control of Venezuelan Oil Sales | The US will oversee Venezuelan oil sales indefinitely, managing the marketing and distribution of oil. |

| Marketing Agreement | Venezuela’s interim leaders consented to US-managed marketing of 30 to 50 million barrels of crude oil. |

| Diluents Supply | The US will supply diluents to prepare Venezuela’s extra-heavy crude oil for sale. |

| Restoration Costs | Revitalizing Venezuela’s oil industry could cost tens of billions of dollars and take time. |

| Projected Production Increase | With capital deployment and maintenance, production could increase by several hundred thousand barrels in the short to medium term. |

| Challenges Faced | Aging infrastructure, low prices, and political instability may hinder rapid production increases. |

| Revenue Management | Revenue from Venezuelan oil sales, potentially exceeding $2 billion, will be under President Trump’s control. |

| Cooperation Requirement | Future plans will require cooperation between the US and Venezuela amidst ongoing political complexities. |

Summary

Venezuelan oil sales have become a focal point of US foreign policy as the US plans to take charge of these operations indefinitely. The recent statements from Energy Secretary Chris Wright underline the commitment to market Venezuelan crude oil, leveraging stored reserves and ensuring that the necessary infrastructure is in place to revitalize production. While there are significant costs and challenges involved, including the need for diluents and capital investment, the potential revenue and strategic importance of Venezuelan oil may drive continued cooperation between the United States and the new Venezuelan leadership.